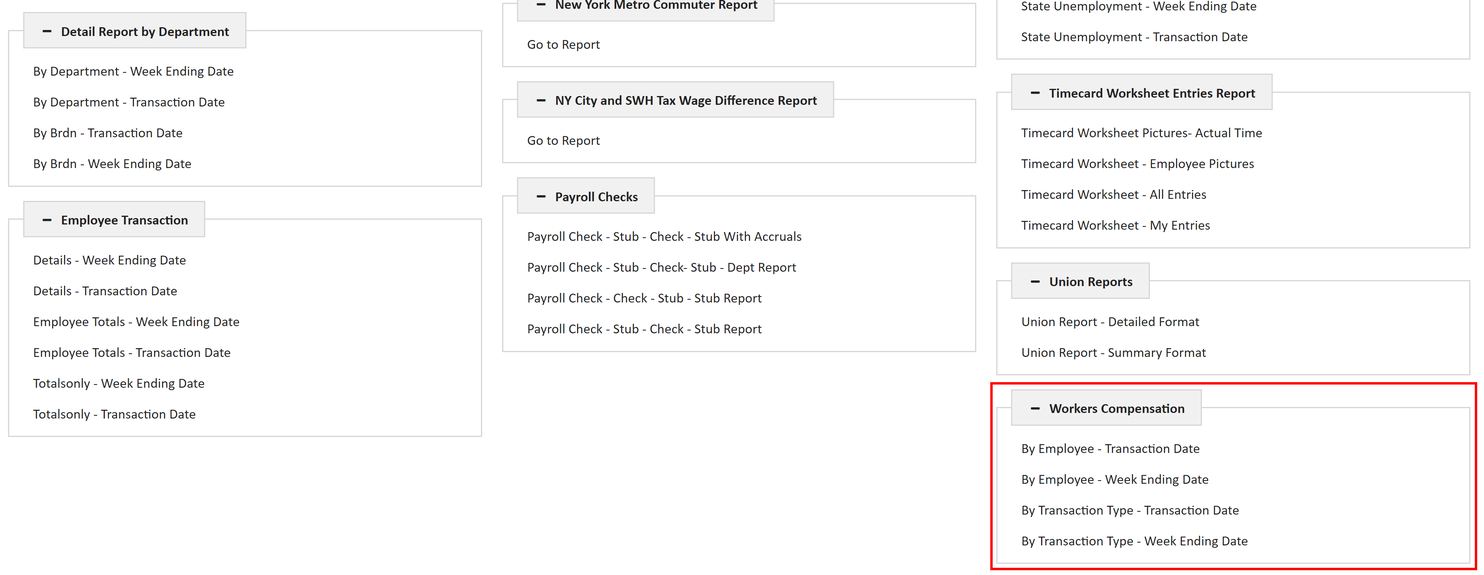

The Workers Compensation Report is used to report the number of payroll wages that are subject to each worker's compensation insurance code. This report is available totaled by each employee or by each transaction type (regular pay, overtime pay, etc.). Both reports show subtotals for each worker's comp code and both reports detail the regular earnings, overtime earnings, and the earnings subject to workers comp insurance.

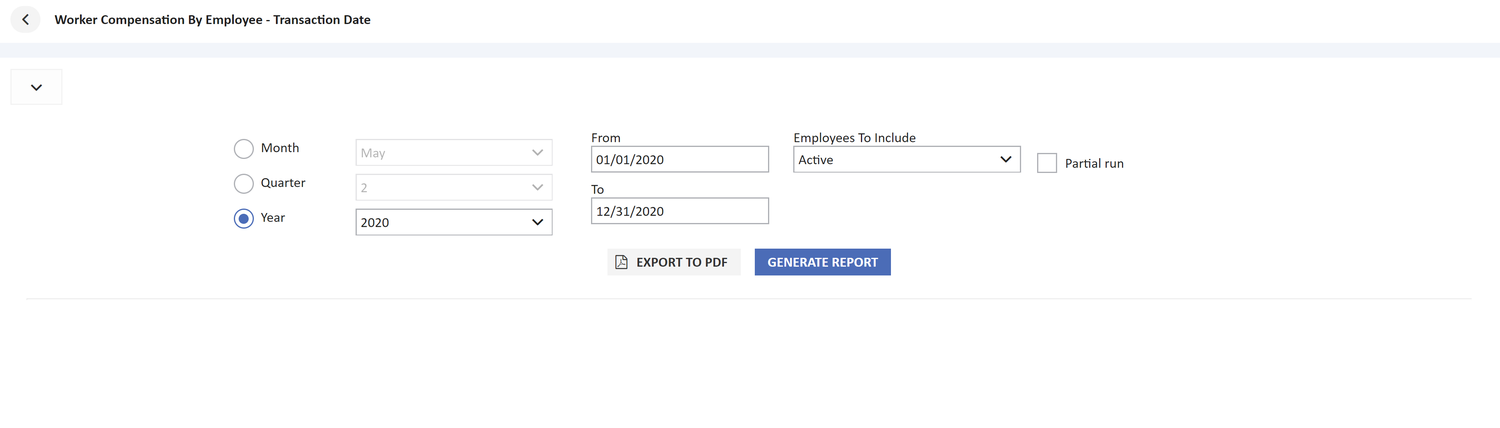

This report is typically generated on a monthly basis as a backup to the monthly audit report supplied by your insurance company. This report should be based on the transaction date (check date) as this is the date of your liability.

The amounts in the Subj Amount column are calculated by taking the regular pay and calculating the overtime pay on a straight time basis. In other words, all the overtime hours are multiplied by the regular hourly rate and the resulting amount is added to the regular pay.

The amounts in the Comp Amount column are calculated by multiplying the wages in the Subj Amount column by the current rates found in the worker's compensation code file.

Hint: The totals from the By Employee – Summary report are more helpful when completing the monthly audit forms from your insurance company. The totals from the By Trans Type – Summary report are more helpful for the auditors that review the report figures on an annual basis.

Note: As this report is dependent on the current rates in the Workers Comp table, be aware that as your rates change, reports for the same period will have different Comp Amount calculations depending on when the rates were updated and the reports were generated.

Click Here to download User Guide

Click Here to download User Guide